Transportation and Logistics

M&A Trends

Mergers and acquisitions (M&A) in the transportation and logistics sector have been dynamic, responding to technological advancements, market demands, and global shifts. These transactions reflect a strategic response by companies to enhance their capabilities, expand market reach, and adapt to the evolving landscape. Several prominent trends have shaped the trajectory of M&A activity in this industry.

Technology Integration and Innovation

Technology has been a key driver in reshaping the transportation and logistics sector. Companies are increasingly leveraging innovations like artificial intelligence, Internet of Things (IoT), blockchain, and data analytics to streamline operations and improve efficiency. M&A activity often centers around acquiring tech companies or platforms that offer solutions for route optimization, supply chain visibility, and real-time tracking. Integrating these technologies helps companies enhance customer experiences, optimize resource allocation, and reduce costs.

E-commerce Boom and Last-Mile Delivery Solutions

The exponential growth of e-commerce has fueled a surge in demand for efficient last-mile delivery solutions. This has led to M&A activities aimed at acquiring or partnering with companies specializing in agile and cost-effective last-mile logistics. Companies seek innovative approaches to meet consumer expectations for faster deliveries while maintaining cost efficiency, prompting strategic acquisitions to strengthen their position in this competitive landscape.

Sustainability and Green Initiatives

The industry is increasingly focused on sustainability and environmental responsibility. Companies are actively seeking eco-friendly solutions to reduce carbon footprints and embrace greener practices. M&A deals often target firms with expertise in alternative fuels, energy-efficient technologies, or sustainable logistics practices. Acquiring such companies enables others to adopt more environmentally conscious approaches, aligning with global sustainability goals and meeting consumer preferences for eco-friendly services.

Supply Chain Resilience and Risk Mitigation

The COVID-19 pandemic highlighted vulnerabilities within global supply chains. In response, companies are prioritizing supply chain resilience and risk mitigation strategies. M&A activities aim to diversify supplier bases, invest in resilient logistics networks, and acquire technologies that enhance adaptability to unforeseen disruptions. These strategic moves ensure smoother operations, reduced dependency on single suppliers, and increased flexibility in adapting to future challenges.

Consolidation for Scale and Efficiency

Consolidation remains a prominent trend in transportation and logistics M&A. Larger entities often acquire or merge with smaller competitors to achieve economies of scale, reduce operational costs, and strengthen market presence. Consolidation enables companies to expand their service offerings, access new markets, and optimize resources, fostering a more competitive industry landscape.

Cross-Border Expansion and Geographic Diversification

To capitalize on emerging markets and broaden their global footprint, companies engage in cross-border M&A. Acquiring firms with established networks in new geographic regions allows companies to expand their reach, access new customer bases, and adapt their services to diverse market demands.

Digitization and Data Utilization

The digital transformation of the transportation and logistics sector has prompted M&A activities focused on data analytics, automation, and digital platforms. Companies seek to acquire firms with advanced analytics capabilities or proprietary software that optimize logistics operations, enhance decision-making processes, and offer competitive advantages in a data-driven environment.

Regulatory Influences

Changes in regulations, including trade policies, compliance standards, and environmental regulations, can significantly impact M&A strategies. Companies engage in acquisitions to navigate regulatory changes effectively, ensuring compliance and leveraging opportunities arising from evolving regulatory landscapes.

In conclusion, the transportation and logistics industry continues to witness transformative M&A activities driven by technological advancements, market demands, sustainability imperatives, and strategic responses to global shifts. These trends shape the industry’s evolution, fostering innovation, efficiency, and adaptation to an ever-changing business environment.

FCL Industry Coverage

- Aviation

- Marine

- Rail

- Trucking

- Distribution

- Equipment Rental

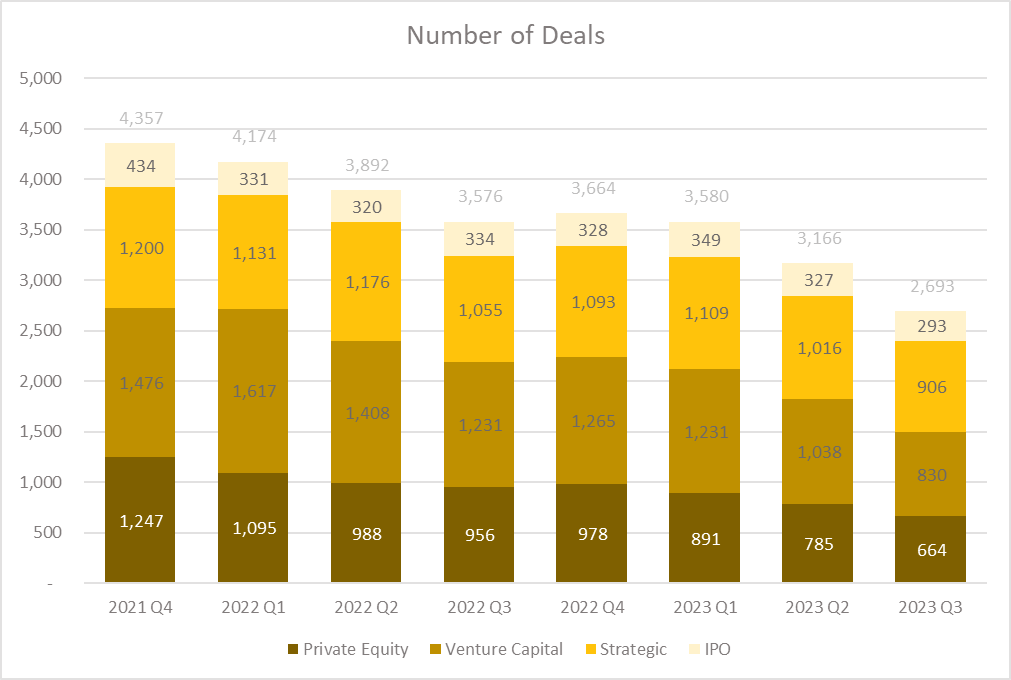

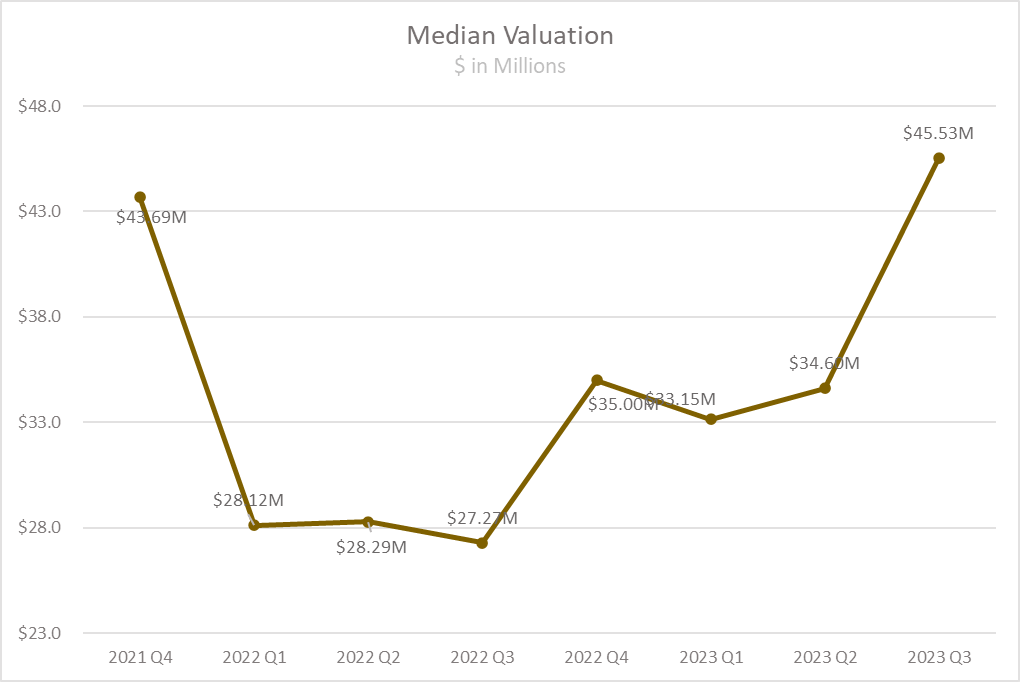

M&A Activity

M&A activity in the transportation sector has seen a consistent decrease since the final quarter of 2021. In Q3 2023, there was a 25% decline compared to the same quarter in the prior year. During this period, the median post-valuation reached a peak at $45.53 million, marking a 37% increase compared to Q1 2023 and an impressive 67% rise compared to Q3 2022.