Technology

The technology industry has not just weathered the pandemic-driven disruptions of the past few years; it has flourished. The crisis thrust many organizations into the future, accelerating digital transformation and changing work models dramatically. But in 2023, the tech industry will likely continue to grapple with issues around supply chains, workforce, and innovation—now exacerbated by considerable macroeconomic and global uncertainties.

While tech stocks outperformed during the pandemic pressures of 2020–21, the sector led considerable stock market declines in 2022. A major challenge now for tech companies is how to weather a potential economic slowdown by trimming costs, increasing efficiency, and growing revenues. At the same time, many are likely looking for ways to remain innovative and build a strong competitive position for the future.

* According to Deloitte’s 2023 Technology industry outlook

FCL Industry Coverage

- Advanced Manufacturing

- AgTech

- Artificial Intelligence

- Cloud

- Cybersecurity

- e-Commerce

- FinTech

- HealthTech

- Internet of Things

- Nanotechnology

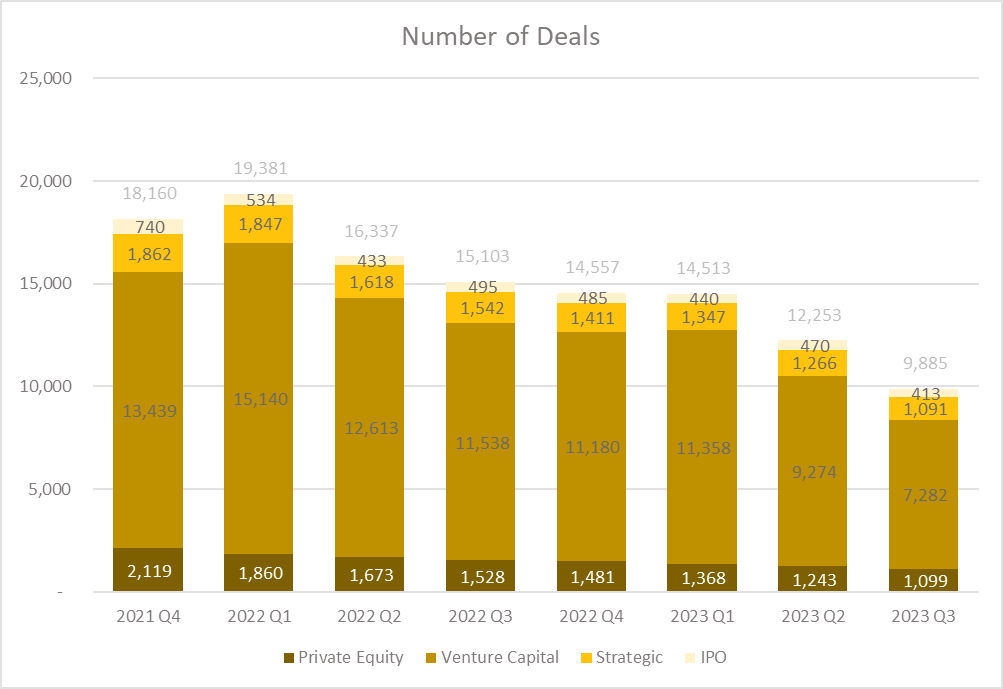

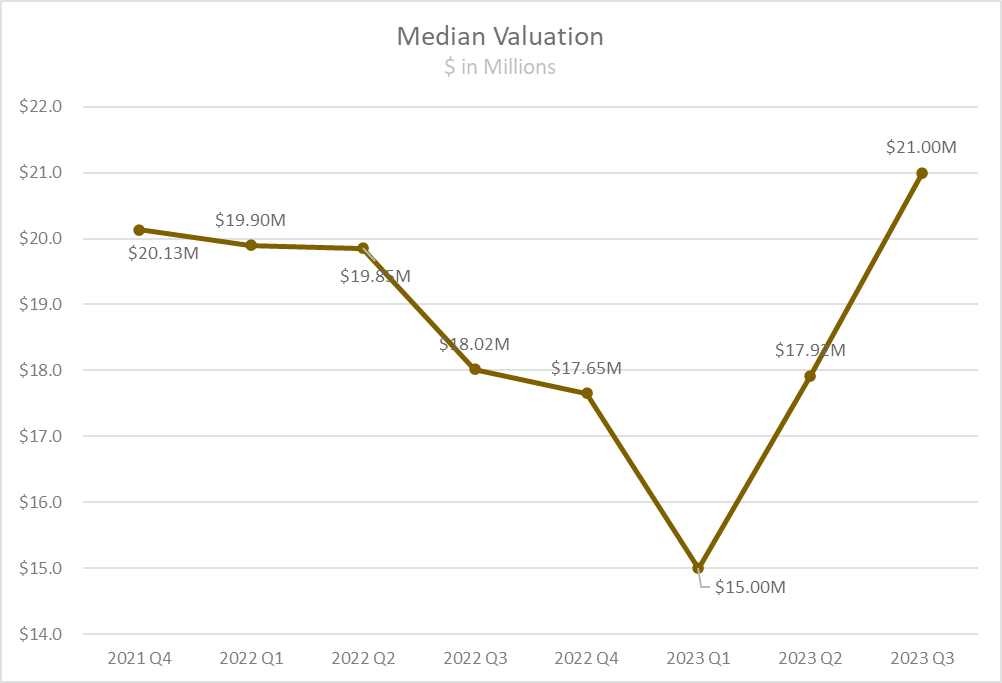

M&A Activity

The sector recorded a significant amount of deals in Q1 2022, but experienced a steep decline in subsequent quarters. Most recently, in Q3 2023, there were 9,885 closed transactions, representing a 35% decrease compared to Q3 2022. Meanwhile, median valuation reached a new record high at $21 million after a substantial decline in Q1 2023.