Business Services

The persistent talent war, a burning issue throughout 2022, shows no signs of cooling in the new year. Professional services firms, grappling with a shortage of quality staff since the post-COVID-19 economic resurgence, face additional challenges due to limited international recruitment options stemming from border closures and visa delays. To counter this, firms are adopting diverse retention strategies, with a focus on flexible working arrangements to accommodate the evolving work culture.

Client experience emerges as a powerful market differentiator in 2023, evolving beyond traditional customer experience paradigms. Firms with superior client experience grow faster, charge more, and boast higher employee satisfaction.

Environmental, social, and governance (ESG) considerations are increasingly influencing professional services in 2023. A firm’s stance on ESG becomes integral to its brand, impacting both employee and client attraction. Aligning with current and prospective employees’ values proves to be an effective retention and attraction strategy. ESG factors are now significant criteria for clients when choosing firms, with workplace diversity, inclusion, and social and environmental sustainability playing key roles.

*According to Beaton’s Professional services trends to watch in 2023

FCL Industry Coverage

- Accounting, Audit and Tax Services

- Buildings and Property Services

- Construction and Engineering

- Consulting Services

- Environmental Services

- Education and Training Services

- Legal Services

- Media and Information Services

- Outsourced Services

- Security Services

- Staffing

- Transportation & Logistics

M&A Activity

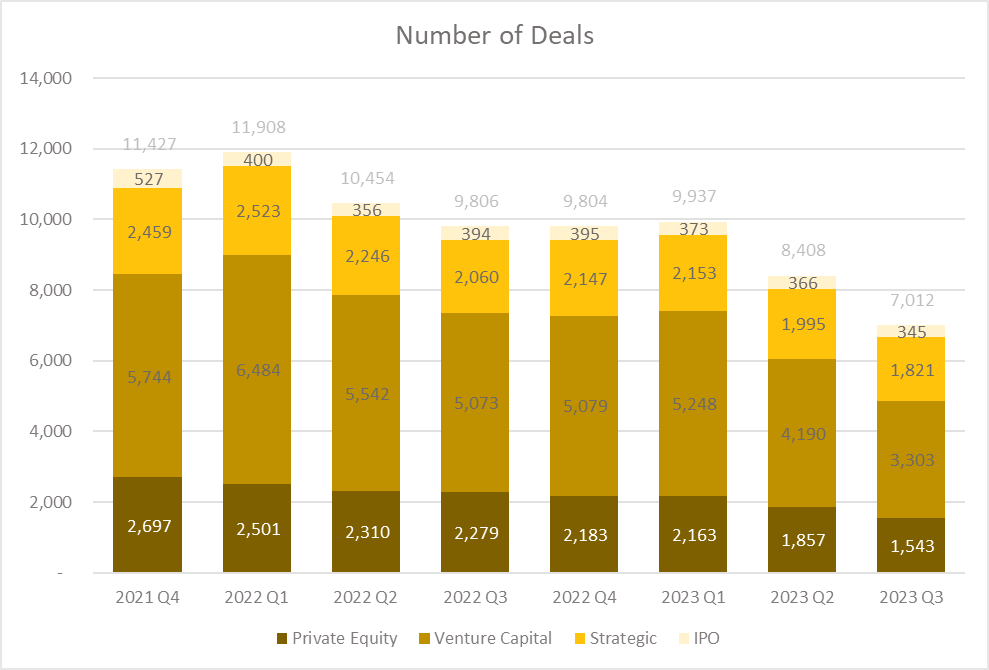

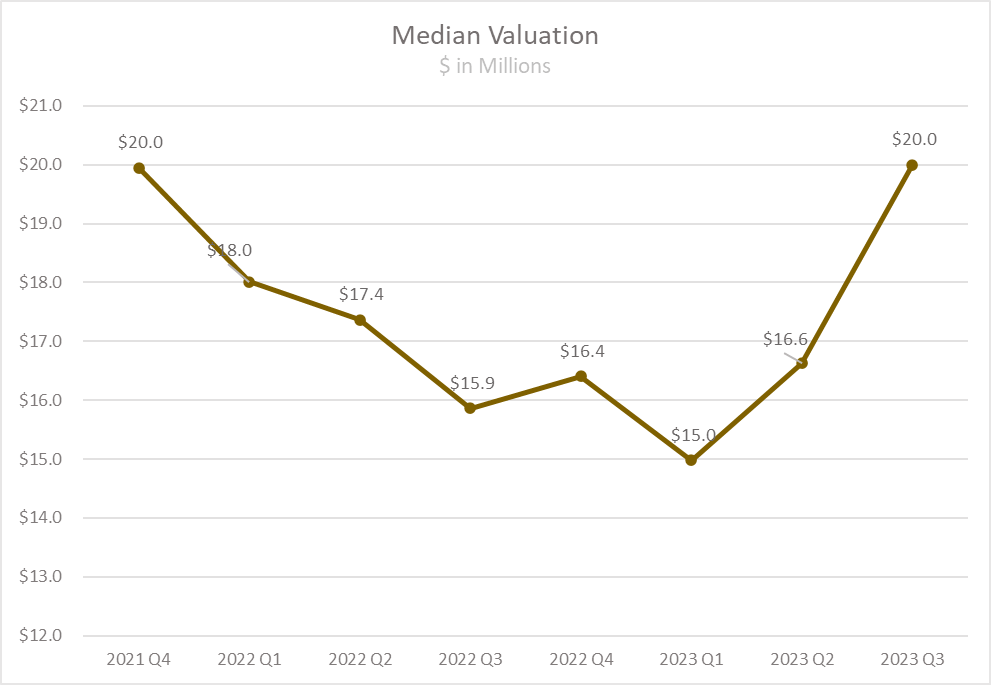

Since Q1 2023, M&A activity in the sector has slowed, with 7,012 deals closed in Q3 2023, a 28% decrease from 9,806 in Q3 2023. Venture capital deals continue to dominate the historical deal landscape, representing 47% of overall deals in Q3 2023. In terms of median valuation, there was a declining trend throughout 2022, followed by a notable upturn in Q3 2023, reaching a record high of $20.0 million, a level last seen in Q4 of 2021.