Manufacturing

Manufacturing has demonstrated continued strength in 2022, building on the momentum it gained emerging from the pandemic, and surpassing expectations from the prior two years. While overall demand and production capacity have hit recent highs, there are indications that the near-term outlook may not be as bright.

The industry is currently experiencing concerns related to inflation and economic uncertainty. In addition, manufacturers continue to grapple with talent challenges that may limit the industry’s growth momentum. Moreover, supply chain issues including sourcing bottlenecks, global logistics backlogs, cost pressures, and cyberattacks will likely remain critical challenges in 2023.

Going forward, as leaders look beyond disruption and revamping their approach, they should consider five important trends for manufacturing playbooks in the year ahead: managing uncertainty; tackling workforce shortages; driving supply chain resiliency; scaling smart factory initiatives to the metaverse; and developing sustainability.

* According to Deloitte’s 2023 Manufacturing Industry Outlook

M&A Activity

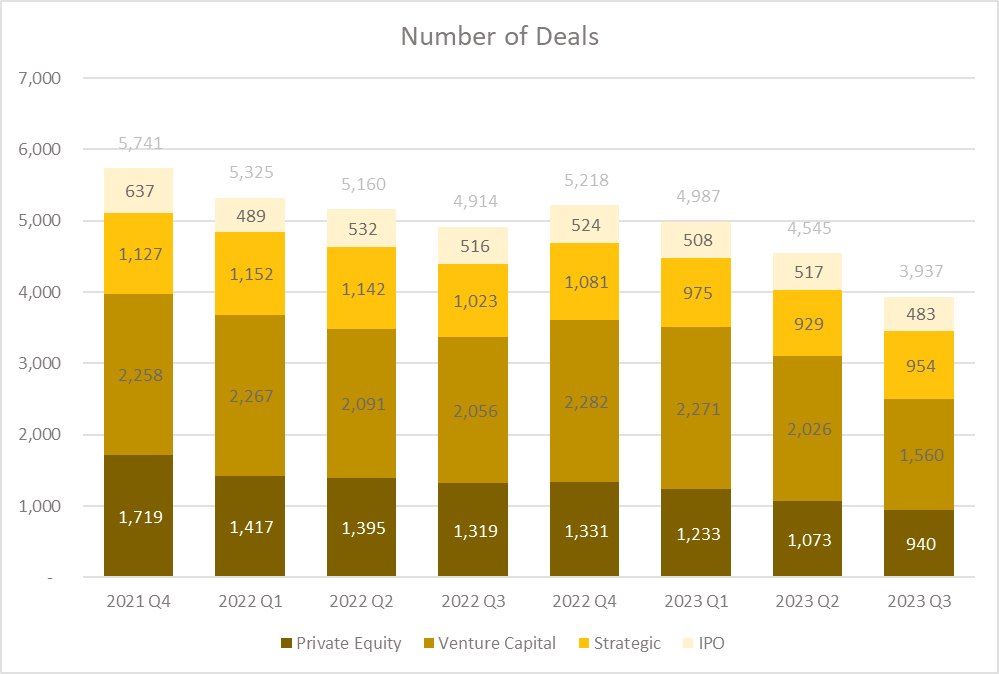

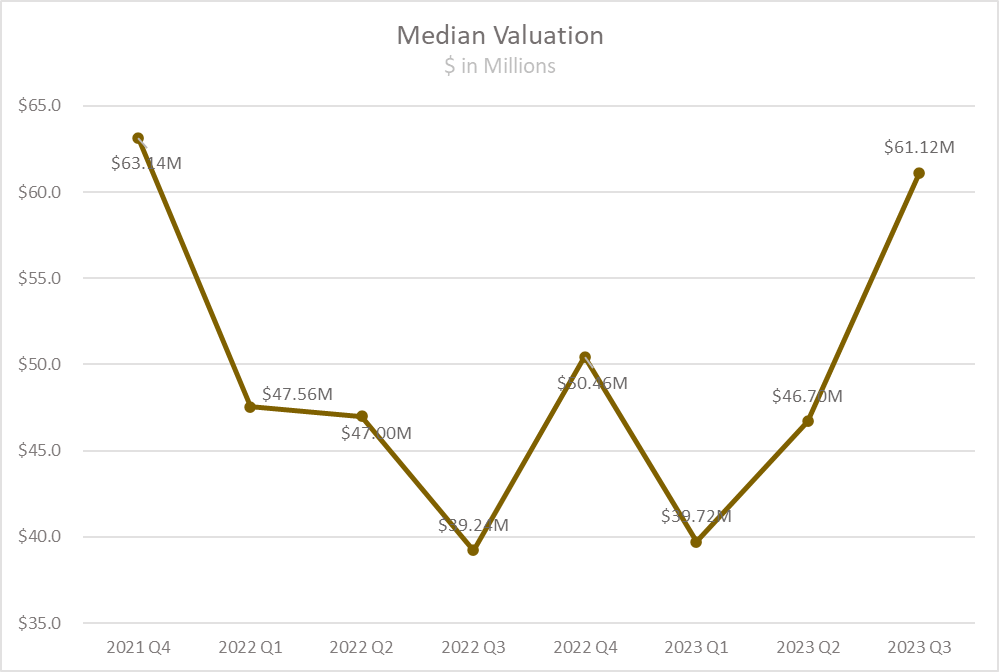

M&A activity in the sector is showing a declining trend after a year of steady deal flow. The third quarter of 2023 saw 3,937 deals closed, an decrease of 20% compared to Q3 2022. Activity in the sector continues to be driven primarily by venture capital deals. Median post-valuation has exhibited a positive trend in the last two quarters, hitting $61.12 million in Q3 2023, approaching the previous record of $63.14 million set in Q4 2021.