Consumer & Retail

In the ever-evolving consumer products industry, navigating the current period presents unprecedented challenges. Amidst this turbulence, the key to success lies in achieving profitable growth while adapting to dynamic consumer demands.

Forward-leaning companies distinguish themselves through strategic investments in direct-to-consumer platforms, product innovation, digital marketing, and analytics. These firms also prioritize market share expansion through pricing differentiation and inorganic growth, often embracing creative transformation approaches such as vertical integration. Supply chain improvements, centered on enhanced data capture and transparency, play a pivotal role.

Despite economic challenges, successful companies maintain a strong commitment to environmental, social, and governance (ESG) goals. The ability to balance consumer engagement, operational efficiency, and a steadfast adherence to ESG principles defines the path forward for sustainable profitability in this complex and ever-changing business landscape.

*Based on Deloitte’s 2023 Consumer Products Industry Outlook

FCL Industry Coverage

- Education

- Food and Beverage

- Household

- Personal Care

M&A Activity

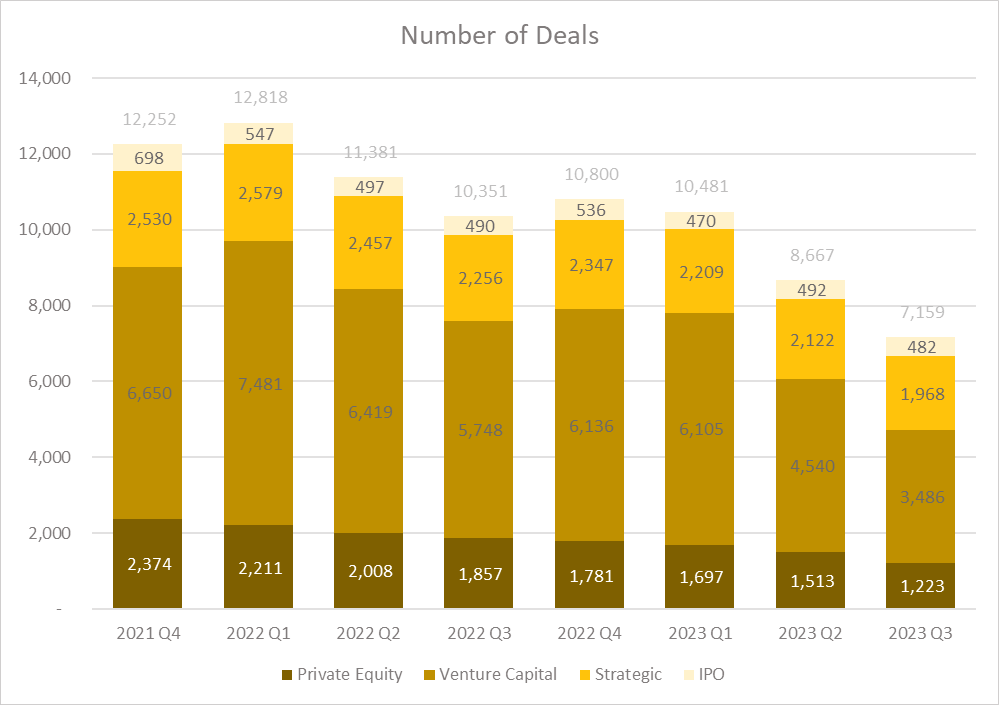

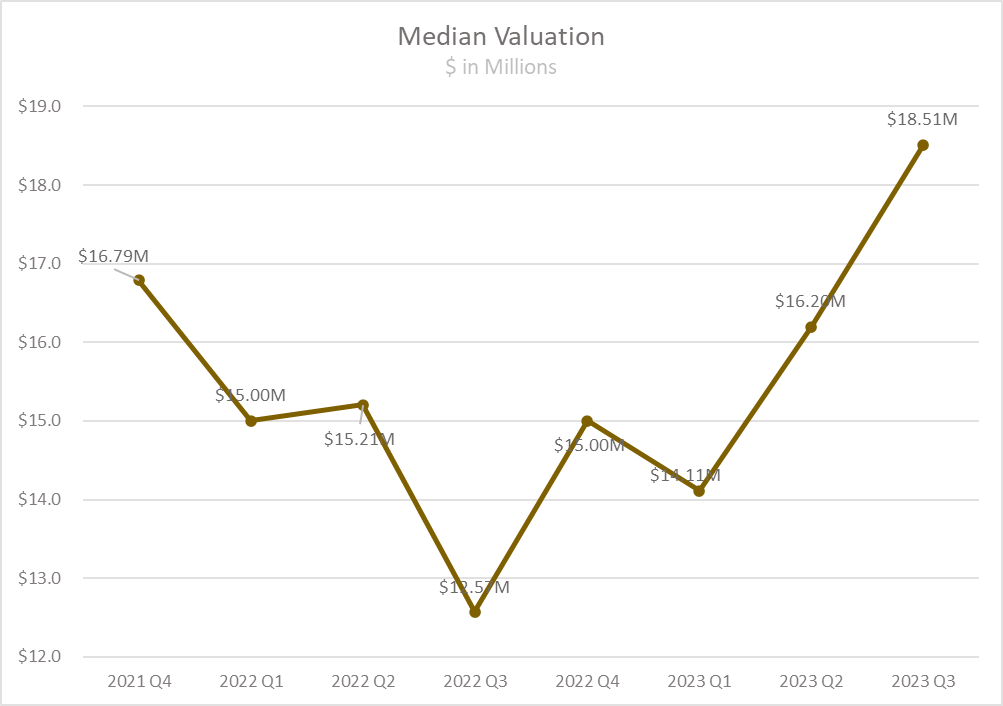

Valuations in consumer markets are beginning to recalibrate as a result of inflation and a slowing economy, which are directly impacting consumers and leading to a decline in consumer sentiment. M&A activity in the sector has exhibited a slowdown since Q1 2023, with 7,159 deals closed in Q3, marking a 31% decrease compared to Q3 2022. A positive trend is evident in median post-valuation for 2023, with Q3 reaching an 8-quarter high at $18.51 million.