Healthcare

Health services executives find themselves at an inflection point in 2023. They face the complex mission of transforming the patient and member experience while economic forces converge to make 2023 a year of reckoning and restructuring. Many are operating with aging technology, outmoded business models and frayed infrastructure. Medical and tech innovators and start-ups are disrupting the market, and care models are being reimagined, giving rise to remote and retail care locations. COVID-19 had already laid bare the challenges of achieving health equity for everyone, while profit margins were becoming razor-thin.

The new year requires more than a recession-ready strategy. It’s imperative to build new capabilities and seize competitive advantage, and every health plan and system needs to summon the courage to change. Those organizations that hold too tightly to traditional playbooks and are complacent in challenging historical roles and views of their purpose risk falling further behind.

* According to Pwc’s Next in health services 2023

FCL Industry Coverage

- Devices & Supplies

- Services

- Technology Systems

- Pharmaceutical & Biotechnology

M&A Activity

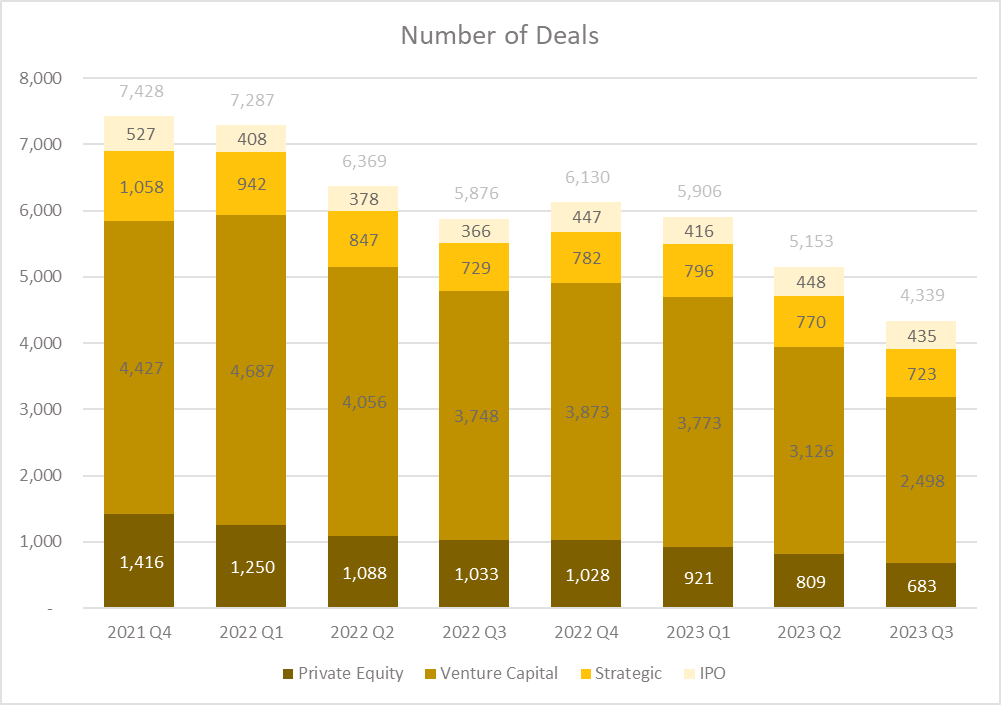

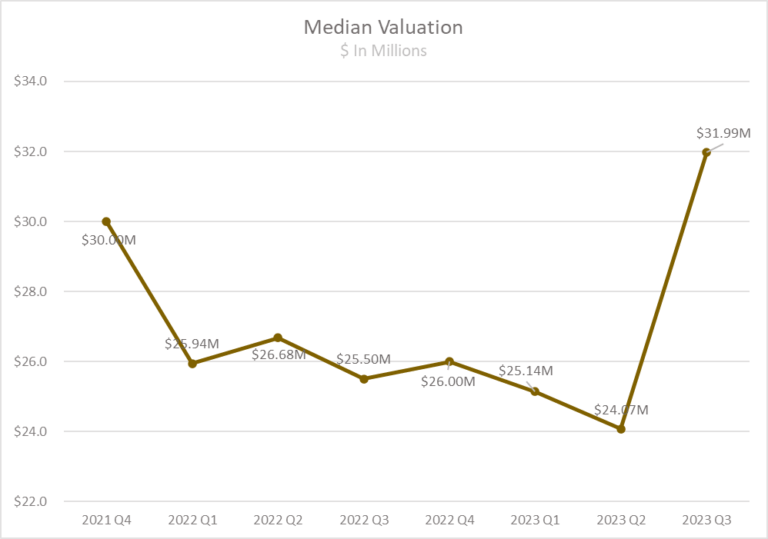

Continuing financial pressures, including possible interest rate hikes, political divisions, and acquisition target valuation uncertainties, might keep healthcare M&A activity subdued in the latter half of the year. However, as sell-side valuations decrease and companies consider divesting non-core assets, these headwinds are expected to ease, potentially bolstering deal-making in the first half of 2024. The volume has seen a continuous decline since reaching a peak in Q4 2022. In Q3 2023, 4,339 deals were recorded, marking a 26% decrease compared to the same quarter in 2022. Median valuation reached its highest point in Q3 2023, setting a new record since Q4 2021 at $31.99 million.