Financial Services

Financial services trends in 2023 will be shaped largely by the confluence of customer needs, technological innovation and policy decisions.

Digitization, decentralization and decarbonization will remain the top three themes of innovation in 2023. While digitization will continue to enhance efficiency, reduce costs and increase revenue streams through diversification into new products and services, decentralization (in particular, enterprise decentralized finance) will open up entirely new business models in the capital markets space.

Decarbonization, coupled with ambitious net-zero goals, will remain a top priority for the industry, having a profound impact on the strategic thinking and future investment decisions of companies.

* According to Forbe’s Six Predictions For Financial Services In 2023

FCL Industry Coverage

- Specialty Lenders

- Wealth Management

- Asset Management

- Private Equity

- FinTech

M&A Activity

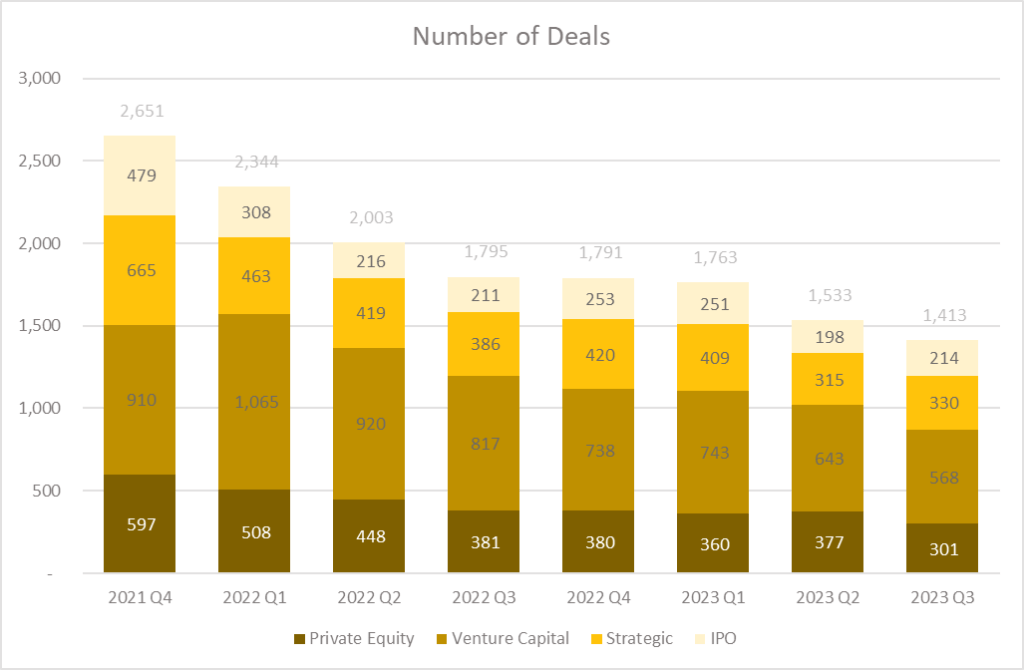

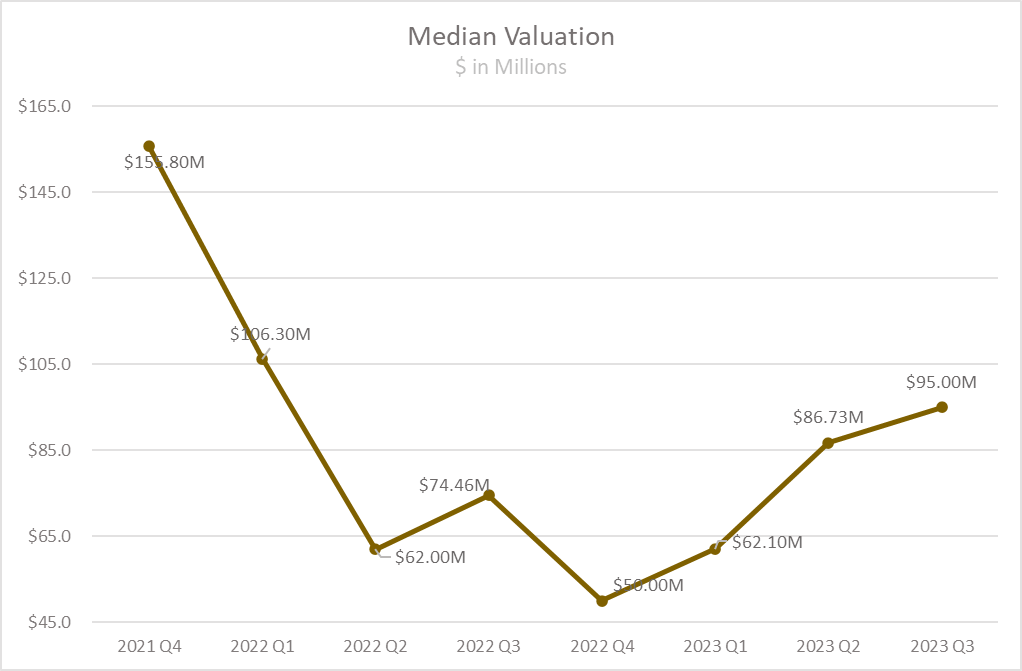

The banking system’s stress in March had a ripple effect across financial markets, sparking concerns about a potential lending slowdown and stricter banking regulations. These factors have subdued M&A activity in the sector during the first half of 2023. Deal volume has been consistently declining since Q4 2021, with 1,413 deals closed in Q3 2023. In contrast, median valuation appears to be on an upward trajectory, reaching $95 million in Q3 2023, reflecting a 28% increase compared to Q3 2022.