Consumer & Retail

Market Trends

Engaging the Value-Seeking Customer

Value can mean different things to different demographics. For some, it’s quality and price, while experience or convenience may be more of a factor for others. Thus, a challenge for retailers is to appeal to a price-conscious consumer who also is looking for value in a personalized manner. As retailers seek competitive advantage with a fragmented, value-seeking consumer base, the move toward customization has become more crucial to help attract and retain consumers.

In-house Delivery Services

In the coming years, retailers are expected to expand their in-house delivery capabilities, in turn creating more automated micro-fulfillment centers to support the expansion of these delivery services. For many years, retailers have offered free omnichannel services, including buy online and pickup in-store, curbside, and even delivery to consumers’ doorstep. Though, consumers have demonstrated a willingness to pay in the delivery space, particularly for more convenience and quicker service. This trend can help retailers drive increased delivery density and profitability in the omnichannel space.

Shoppable Media

To engage with younger customers, it has become increasingly essential for retailers to incorporate social commerce, influencers, and shoppable media. With younger generations often spending more of their time on devices, video games, and social media, retailers have an opportunity to access engaged audiences and lower acquisition costs.

People and Productivity

Labor costs remain a concern for retailers as they grapple with high turnover rates, as expectations for employees to stay long-term, even at managerial levels, have changed for some. High turnover, ultimately, can impact shoppers. Attracting the right people, getting them up to speed quickly, and working to ensure they are productive as soon as possible are essential to the success of the business and the consumer experience.

*Source: Deloitte – 2025 US Retail Industry Outlook

FCL Industry Coverage

- Education

- Food & Beverage

- Health & Wellness

- Household

- Pet Products & Services

M&A Activity

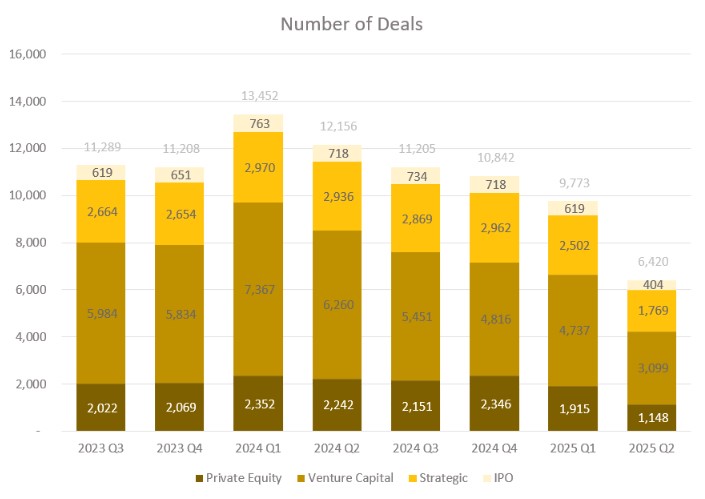

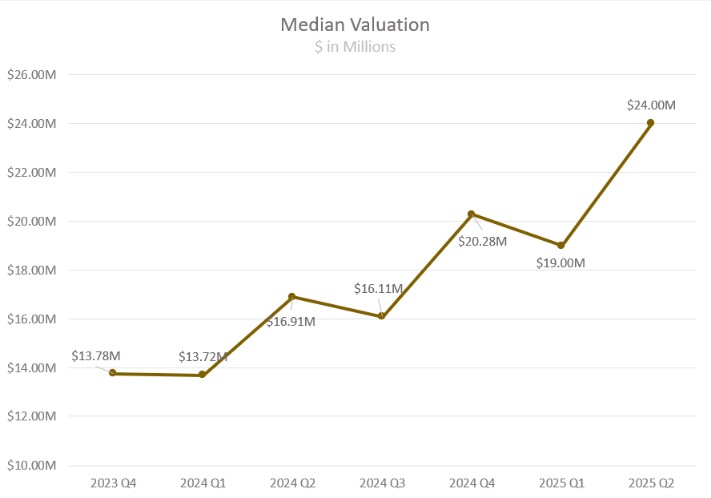

M&A activity in the consumer retail sector has exhibited a slowdown since Q1 2024, with only 6,420 deals closed in Q2 2025, marking a 47.2% year-over-year decrease. Valuations have been volatile since Q1 2024, accelerating rapidly in Q4 2024 and reaching a record high of $24 million to close out the first half of 2025. Comparing Q2 2025 to Q2 2024, median valuations rose by 42%, reflecting a heightened investor appetite for higher-value deals in the sector. The inverse relationship between deal volume and median valuation highlights recent market uncertainty in consumer retail, while also signaling robust confidence in the sector’s value despite a decline in overall market sentiment.